Be aware of common pay scams in the warehouse industryMinimum Wage:

As of July 1, 2020, Illinois minimum wage is:

On January 1st, 2021, Illinois minimum wage will increase to $11/hour for adults who do not receive tips, $6.60 for tipped workers, and $8.50 for youths. As of July 1, 2020, minimum wage in the City of Chicago is:

If you are paid "production pay" or "piece rate" (like if you’re paid a certain amount per truck unloaded) your pay must equal at least minimum wage. Overtime

Payroll Cards

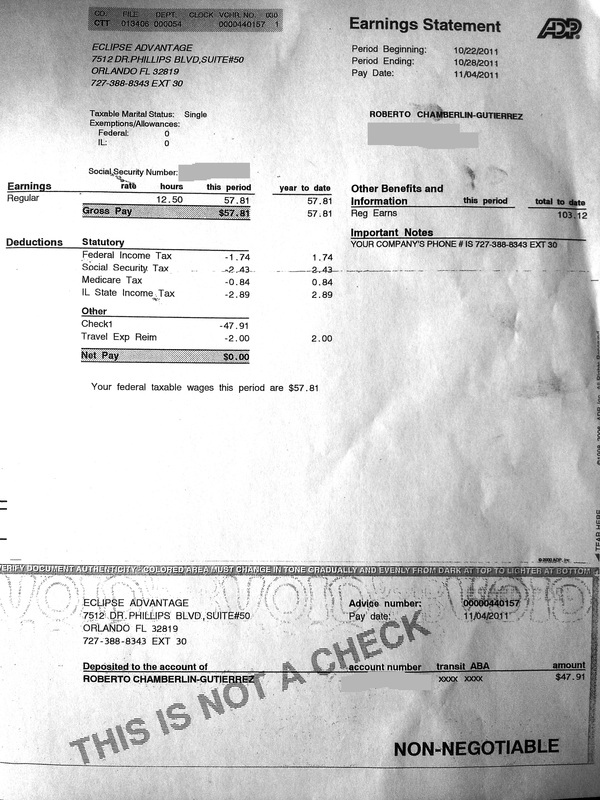

Deductions From Your Check

|

Problems with your check? Contact WWJ for help